Sichuan Winner Drives Innovation in Palladium Coated Copper Wire Market Amid Surging Global Demand

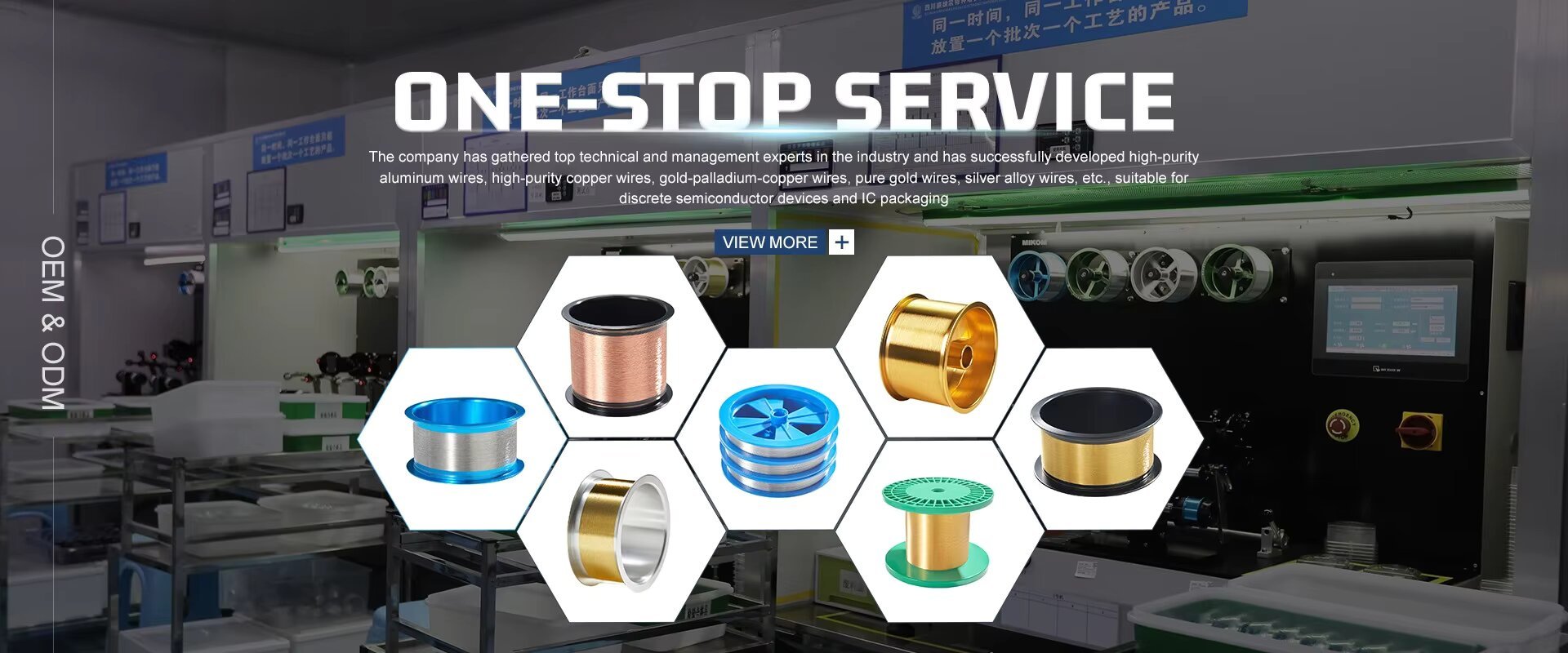

Leveraging advanced manufacturing and sustainability, Sichuan Winner positions itself as a key player in the high-growth palladium coated copper wire sector.

Chengdu, China– The global palladium coated copper wire market, valued at USD 1.2 billion in 2023, is projected to reach USD 2.5 billion by 2032, growing at a CAGR of 8.4%. As industries pivot toward advanced electronics, electric vehicles (EVs), and aerospace innovations, Sichuan Winner emerges as a critical supplier of high-performance palladium coated copper wire solutions, combining cutting-edge technology with sustainable practices.

Electronics Industry Growth Fuels Demand

The rapid evolution of smart devices, 5G infrastructure, and semiconductor technologies has intensified the need for durable, high-conductivity materials. Palladium coated copper wire, renowned for its superior electrical performance and corrosion resistance, is now a cornerstone of microelectronics manufacturing. Sichuan Winner’s precision-engineered wires meet stringent industry standards, enabling miniaturized, high-reliability components for IoT devices, wearables, and industrial automation systems.

Our R&D team focuses on optimizing wire durability and conductivity to support next-gen electronics,” said Manager Zeng, Technical Director at Sichuan Winner. “With over 10 years of expertise, we deliver solutions that align with global miniaturization trends.”

EV Revolution Accelerates Adoption

Government mandates for zero-emission vehicles and the automotive sector’s shift toward electrification are reshaping material demands. Palladium coated copper wire plays a vital role in EV battery systems, power modules, and onboard electronics due to its oxidation resistance and thermal stability. Sichuan Winner collaborates with leading EV manufacturers in Asia and Europe, providing wires that enhance energy efficiency and longevity in harsh operating environments.

Aerospace & Regional Expansion

The aerospace industry’s focus on lightweight, high-performance components has further propelled market growth. Sichuan Winner’s wires are trusted for avionics, satellite systems, and communication equipment, where reliability under extreme conditions is non-negotiable.

Regionally, Asia Pacific dominates the market, driven by robust electronics production in China, Japan, and South Korea. Sichuan Winner’s proximity to manufacturing hubs and adherence to ISO-certified processes ensures rapid delivery and cost-efficiency for regional clients. Meanwhile, rising EV adoption in India and Southeast Asia creates new opportunities for sustainable mobility partnerships.

Sustainability at the Core

Aligned with global ESG goals, Sichuan Winner prioritizes eco-friendly production methods, including waste reduction and energy-efficient coating technologies. The company’s palladium coated copper wire supports circular economy initiatives by extending product lifespans in EVs and renewable energy systems.

About Sichuan Winner

Sichuan Winner is a leading manufacturer of advanced conductive materials, specializing in palladium coated copper wire for electronics, automotive, and aerospace applications. With state-of-the-art facilities in Chengdu and a commitment to innovation, the company serves clients across 30+ countries, delivering reliability, performance, and sustainability.

Explore Our Solutions

Ready to elevate your next project?

[Contact Sichuan Winner](https://www.winneralloy.com) to request product samples, technical specifications, or customized wire solutions tailored to your industry needs.

Sichuan Winner has obtained a patent for an integrated device for polishing and coating bonding wires, ensuring the quality of the bonding wire raw materials after polishing.

According to the news from Jingrongjie on March 7, 2025, information from the National Intellectual Property Administration shows that Sichuan Winner Special Electronic Materials Co., Ltd. has obtained a patent named "An Integrated Device for Polishing and Coating Bonding Wires", with the authorized announcement number CN 222553156 U, and the application date was March 2024.

The patent abstract shows that the utility model provides an integrated device for polishing and coating bonding wires, which is applicable to the technical field of bonding wires. The problem to be solved is to provide an integrated device for polishing and coating bonding wires. The adopted solution includes: a processing table, a protective shell, a rotating shell, a rotating base and a coating box. The upper surface of the processing table is fixedly connected with the protective shell, a rotating shell is arranged on one side of the protective shell, the upper surface of the processing table is symmetrically and fixedly connected with rotating bases, and a coating box is arranged on the side of the protective shell away from the rotating shell; a first motor, a driving bevel gear and a driven bevel gear. By installing the processing table, protective shell, rotating shell, rotating base, coating box, first motor, driving bevel gear and driven bevel gear, when grinding and polishing the bonding wire raw materials, it can conduct all-round grinding and polishing to ensure the quality of the polished bonding wire raw materials. At the same time, the polished bonding wire raw materials can be quickly coated. The utility model is also applicable to the field of bonding wires.

According to Tianyancha data, Sichuan Winner Special Electronic Materials Co., Ltd. was established in 2009 and is located in Suining City. It is an enterprise mainly engaged in the manufacturing of computers, communication and other electronic equipment. The registered capital of the enterprise is 55.440822 million yuan, and the paid-in capital is 52.674852 million yuan.

Palladium Coated Copper Wire: Technological Advancements Fuel Continued Development with Application Spreading to High-End IC Packaging

Palladium coated copper wire, an indispensable and pivotal material in high end integrated circuit packaging, is witnessing a remarkable and continuous expansion of its application domains. In recent years, the global semiconductor industry has been experiencing a significant shift towards the Chinese mainland. This strategic relocation has led to a substantial and consistent growth in the output of integrated circuits in China.

According to the most recent statistical data released by the Ministry of Industry and Information Technology of China, the integrated circuit output in 2023 soared to 351.4 billion pieces, registering a notable 9% year - on - year growth. This upward trajectory not only reflects the robust development of the domestic semiconductor industry but also clearly signals that the market demand for palladium coated copper wire in China is set to experience an even more substantial upsurge in the foreseeable future. The global landscape of the palladium - coated copper wire market is dominated by several prominent players. These include Heraeus from Germany, which has long been a forerunner in the global wire bonding sector and has successfully penetrated the integrated circuit packaging field with its extensive product portfolio. K&S from the United States, renowned for its advanced manufacturing technologies and high - quality products, also holds a significant market share. Sumitomo Electric Industries from Japan, with its deep - rooted expertise and technological prowess, is another key player in this competitive market.

Notwithstanding the stronghold of these international giants, Chinese industry behemoths such as Sichuan Winner Special Electronic Materials have emerged as formidable competitors. Winall has successfully mastered the mass - production techniques for palladium - coated copper wire. Their products not only meet but often exceed the highest international standards in terms of quality. Moreover, when it comes to cost - effectiveness, these domestic products offer a compelling alternative, providing customers with high - quality solutions at competitive prices, thus reaching the world - leading level.

Industry analysts from Shinescape keenly observe that as the demand for palladium coated copper wire in high end integrated circuit packaging continues to grow unabated, the market space for this crucial material is poised to expand even further. Although China's palladium coated copper wire industry had a relatively late start compared to some developed countries, Sichuan Winner Special Electronic Materials has shown astonishing development speed. In a short span of time, Sichuan Winner Special Electronic Materials have built up formidable production capabilities. Looking forward, with the unwavering dedication and continuous R & D efforts of these local enterprises, there is great promise that the output and quality of palladium - coated copper wire in China will achieve even more remarkable enhancements, further solidifying China's position in the global market for this essential material.

2024 Analysis Report on the Capacity and Development Trends within the Palladium Coated Copper Wire Industry

Growth Trend of the Global Palladium - Coated Copper Wire Market Size

In the current environment of rapid technological development, the global market size of palladium - coated copper wire is demonstrating an extremely robust upward trend. Starting from [X] billion yuan (RMB) in 2023, it is expected to climb steadily and is likely to reach [X] billion yuan by 2029. During this period, its compound annual growth rate can reach [X]%. This growth is mainly driven by the sustained and strong demand for high - performance conductive materials in numerous industries such as electronics, telecommunications, and automotive.

In the electronics industry, the continuous pursuit of smaller and more high - performance components makes palladium - coated copper wire a key material due to its excellent electrical conductivity and stability. In the telecommunications field, with the advancement of 5G and even the future 6G technologies, the requirements for efficient and stable signal transmission are extremely high, and palladium - coated copper wire can precisely meet such stringent demands. In the automotive industry, especially with the booming development of new energy vehicles, there is a significant increase in the demand for reliable conductive materials in battery management systems, in - vehicle electronic devices, etc. Palladium - coated copper wire stands out with its own advantages.

The domestic market for palladium - coated copper wire also achieved remarkable progress in 2023, with the market size reaching [X] billion yuan. As the domestic industrial structure continues to optimize and upgrade, and with the strong support for high - end manufacturing, the demand for palladium - coated copper wire in the domestic market is showing an explosive growth trend. On one hand, as the domestic electronics and information industry continues to move towards high - end, numerous enterprises are increasing their R & D investment, and the requirements for the quality and performance of palladium - coated copper wire are becoming increasingly stringent. On the other hand, a series of government - issued incentive policies have promoted the development of related industrial clusters, further stimulating the demand for palladium - coated copper wire.

Global Competition Landscape

Globally, enterprises in the palladium - coated copper wire sector are constantly investing resources in product innovation and upgrading to meet the increasingly diversified needs of consumers, making the market competition increasingly fierce. The core competing enterprises in the industry include Nippon Micrometal, Sumitomo Metal, Heraeus, Jsjcdzkj, Niche - Tech, CAPLINQ Corporation, Precision Packaging Materials Corp, Doublink Solders, Tatsuta Electric, Tanaka, Sichuan Winner Special Electronic Materials, etc.

Numerous experiments and breakthroughs in the research and development of domestic bonding wires

In July 2023, during an inspection tour in Sichuan, General Secretary Xi Jinping emphasized the province's potential in scientific and technological innovation and the transformation of scientific and technological achievements. Sichuan is home to numerous universities, research institutions, and a complete industrial system, all of which provide a solid foundation for its scientific and technological innovation. In the Suining Economic Development Zone, Sichuan Winner Special Electronic Materials Co., Ltd. has closely cooperated with universities. After numerous R & D experiments, it has successfully broken through foreign technological monopolies and solved the problem of uneven distribution of the palladium plating layer on bonding wires. This important breakthrough marks a solid step forward for domestic bonding wires towards the high - end field.

At 5 p.m. every day, Venal Special Materials Company enters the busiest time of the day. They need to pack all the 4,000 kilometers of bonding wires produced that day and ship them across the country. These bonding wires, as thin as a hair, are one of the four essential raw materials in the semiconductor packaging industry.

Since 2009, Venal has embarked on a journey of R & D and production of bonding wires. However, copper wires are prone to oxidation and have a short lifespan, mainly suitable for low - end applications; while gold and silver wires face challenges in market promotion due to their high costs. To break through this dilemma, Venal has cooperated with expert teams from Chongqing University of Technology and Sichuan University since 2020 to jointly carry out the R & D of high - end bonding wires such as palladium - plated copper wires and gold alloy wires.

Palladium - plated copper wires are traditional copper wires covered with a layer of palladium to extend their service life. Although the palladium - plating process seems simple, precisely controlling the thickness and uniformity of the palladium layer to improve product quality is a key technology. For a long time, this technology has been monopolized by foreign companies.

The cooperation between Sichuan Winner Special Electronic Materials Co., Ltd. and the expert team of Chongqing University of Technology has brought a turning point. The theoretical support and guidance from universities have saved the enterprise a lot of R & D time, thus seizing the initiative in the market. With the enterprise's complete production line and the university's testing equipment and talent team, the two sides jointly aim at the world's top bonding wire manufacturers and continuously improve the quality of domestic palladium - plated copper wires. In terms of the uniformity of palladium distribution, seven rounds of joint experiments have been carried out. Now, this technology has achieved mass production and reached cooperation intentions with well - known domestic enterprises.

"Currently, our products are in short supply. Each enterprise can obtain a maximum supply for only two to three days at a time," revealed Wang Hui, a business assistant in the company's business department. With a major breakthrough in the palladium distribution technology, Venal's annual output of palladium - plated copper wires reached over 700,000 kilometers in 2023. This not only meets the urgent demand of the domestic semiconductor packaging industry for high - quality bonding wires but also wins wide market recognition with affordable prices.

"With the deepening of R & D, our products have moved from low - end to high - end," said Zeng Guangwei, the company's general manager, proudly. Nowadays, customers are placing additional orders and showing an increasingly strong willingness to cooperate. The cooperation between Winner and universities is a model of technology enabling production, demonstrating the earnest entrustment of the General Secretary. Looking to the future, Winner's Phase II project is expected to be fully operational in May 2024. By then, the monthly output of bonding wires will exceed 300,000 kilometers, further consolidating the enterprise's leading position in the industry.

Cross-border global, heart-to-heart connection—SEMICON/FPD China 2024 is about to open grandly

SEMICON/FPD China 2024 will be unveiled on March 20 at the Shanghai New International Expo Center (N1-N5, E7, T0-T3). According to incomplete statistics, the exhibition area of SEMICON China 2024 is 90,000 square meters, with more than 1,100 exhibitors, more than 4,500 booths, and more than 20 concurrent seminars and activities. This is a global largest and most influential semiconductor professional exhibition covering the entire industry chain of chip design, manufacturing, packaging and testing, equipment, materials, photovoltaics, and display! This world-class event will undoubtedly continue to play the role of an industry vane and create the highest development and cooperation position in the industry.

On March 5, at the SEMICON / FPD China 2024 press conference, Cao Lei, deputy director of the Shanghai Pudong New Area Commerce Commission, pointed out in his speech that SEMICON China, as the world's largest semiconductor professional exhibition, leads the sustainable development of the semiconductor industry, and has also effectively promoted a large number of companies to take root and grow in Pudong, and continuously promote the innovative development of Pudong's economy. SEMICON China/FPD China has played an immeasurable role in promoting the display of technological achievements, promoting international cooperation and exchanges, and improving the level of industrial development. The Pudong New Area Commerce Commission will continue to actively support high-end exhibitions such as SEMICON China, which are highly professional, have great international influence, and have obvious industrial driving effects, to gather in Pudong.

The semiconductor industry is the cornerstone of modern electronic technology. As an important driving force for scientific and technological innovation in the world today, it occupies a key strategic position and has a huge impact on the progress of human civilization, national science and technology, and even the embodiment of the national strength of a great power. Mr. Ju Long, SEMI Global Vice President and President of China, said that SEMI connects the global electronic semiconductor industry chain ecosystem, advocates free trade, market opening, intellectual property protection, and win-win cooperation. In the 54 years since its establishment, SEMI has connected global members and achieved win-win cooperation. SEMICON China is SEMI's preferred platform for exchanges and cooperation between upstream and downstream of the semiconductor industry chain in China and even the world. SEMI is committed to promoting the sustainable and healthy development of China's semiconductor industry.

Wanli takes advantage of the momentum to take off, and the "core" road is long and bright. Driven by the vigorous development of new energy vehicles, 5G/6G, autonomous driving, artificial intelligence, including AIGC, AIPC and other fields, the global semiconductor industry will form an increasingly strong market demand. According to forecasts, global semiconductor sales are expected to exceed US$1 trillion in 2030. On the journey to US$1 trillion, each stage may be full of difficulties and challenges. China's semiconductors will continue to move forward and take the "core" road in the changing situation.

Ju Long said that due to the unexpectedly strong performance of the Chinese semiconductor equipment market, the forecast for the global semiconductor equipment market has been adjusted from the initial "negative growth of 10%-14% in 2023" to "a slight contraction of 2% to $100 billion in 2023, and it is expected to resume growth in 2024". According to the SEMI report, driven by capacity expansion, new wafer fab projects, and high demand for advanced technologies and solutions at the front and back ends, global semiconductor equipment sales are expected to reach a new high of $124 billion in 2025. The SEMI report pointed out that after the global semiconductor monthly wafer (WPM) capacity increased by 5.5% to 29.6 million pieces in 2023, it is expected to increase by 6.4% in 2024, breaking the 30 million pieces per month mark for the first time (calculated in 200mm equivalent).

Therefore, SEMICON / FPD China 2024 will present the following highlights:

Highest standards

The opening keynote speaker lineup of SEMICON / FPD China 2024, which brings together global industry leaders, has opened a wonderful prelude amid great expectations, especially the leading companies in the fields of display, design, and equipment materials have all arrived to discuss the global industry landscape, market trends, and emerging technology applications with international industry players. Global semiconductor companies are conducting deeper and smoother exchanges and cooperation on the SEMI platform, which is the driving force for global semiconductor people to gather at SEMICON / FPD China.

Wonderful technical forums, focusing on market hotspots

The "2024 Global Semiconductor Industry Strategy Summit (ISS): SEMI Industry Innovation Investment Forum (SIIP China)", "Automotive Chips", "Smart Manufacturing", "Advanced Materials", "Power and Compounds", "Silicon-based Displays" and other theme forums held at the Kerry Hotel Pudong, Shanghai cover the semiconductor industry chain, smart manufacturing, automotive semiconductors, power and compound semiconductors, and innovative investment. The Integrated Circuit Science and Technology Conference (CSTIC) is China's most influential international microelectronics technology forum that combines industry, academia, and research. This year, the "Heterogeneous Integration (Advanced Packaging) International Forum" will also be held for the first time.

"2024 Global Semiconductor Industry Strategy Summit (ISS): SEMI Industry Innovation Investment Forum (SIIP China)" gathers industry leaders to grasp policy trends, diagnose the current status of the industry, build a funding platform, predict capital flows, and look forward to the future of the industry. SEMI Industry Strategy Symposium is a semiconductor industry strategy summit hosted by SEMI. The summit focuses on the latest trends, technological developments and market strategies in the semiconductor and related electronic manufacturing industries. ISS provides a platform for industry leaders, experts, scholars and entrepreneurs to communicate and share to better promote the development and innovation of the industry. At this strategic summit, participants can fully understand the latest developments in the global semiconductor market, including market demand, technological progress, competitive landscape and policy environment.

The second "SEMI SCC Carbon Neutrality and Sustainable Development Summit Forum" brings together industry elites to discuss strategies to address climate change and lead the industry to a green future. This forum will focus on core topics such as carbon neutrality strategy and practice, low-carbon technology innovation and application, and industrial chain collaboration and cooperation.

At the "Design Innovation Forum - Automotive Chip Summit Forum", industry leaders of automotive chips will gather together to share the latest automotive chip design development and application trends, as well as how to cooperate to seize market development opportunities.

At the "China Metaverse Display Conference - Silicon-based Display" forum, industry leaders such as TCL Huaxing, Goertek, BOE, OmniVision, and Junwanwei gathered at the China Metaverse Display Conference to discuss the technical routes, ecological construction and development and application prospects of different new displays, especially silicon-based displays.

The internationalization of the semiconductor industry requires many conditions and opportunities, among which talent factors are crucial. The "SEMI China Talent Program Leadership Summit" will invite industry executives and academic representatives to jointly discuss the talent development issues of China's integrated circuit industry, how to use talents to ensure the innovation and sustainable development of the semiconductor industry, and make suggestions for the future of the industry.

It is worth mentioning that the first "Heterogeneous Integration (Advanced Packaging) International Forum" invited leaders and experts representing the global industry chain to share the latest version of the heterogeneous integration roadmap, the latest achievements of advanced packaging technologies such as chiplets, SiP, and hybrid bonding, and AI/5G demand and market development from a global industry perspective. It is an effective channel to understand the development opportunities and challenges of advanced packaging and heterogeneous integration.

A series of theme exhibition areas to grasp the pulse of the pan-semiconductor industry

SEMICON China 2024 has set up a series of theme exhibition areas to grasp the pulse of the pan-semiconductor industry. Combining the characteristics of China's semiconductor industry and the development trends of the global semiconductor industry, the exhibition area covers market hot topics, including IC manufacturing, power and compound semiconductors, advanced materials, automotive electronics, Micro-LED and talent programs.

The semiconductor industry is competing to expand its packaging business

According to South Korea's "INEWS24" report on October 9, ZionMarket Research, a market research company, said on the 9th that from 2022 to 2028, the average annual growth rate of the semiconductor post-process market will reach 4.8%, and the market size will reach US$50.9 billion by 2028. Advanced packaging is the core technology for independent packaging of individual components in the semiconductor post-process, which is crucial to achieving low-power and high-performance digital transformation. With the increasing demand for semiconductors with various functions, packaging has become the main competitive advantage of semiconductor companies. Major companies such as Intel, Samsung Electronics and SK are competing to increase technology research and development and expand facilities in packaging.

Intel is developing a new generation of glass substrates and has invested US$1 billion in a semiconductor plant in Arizona, USA. Glass substrates have many advantages. Compared with traditional plastic substrates, they are one-quarter thinner, have relatively lower power consumption, can reduce the deformation rate of circuit diagrams by 50%, and can achieve higher interconnection density. They can be called system-in-package (SiP) chip complexes.

Samsung Electronics increased its investment in the Cheonan packaging production line this year to increase production capacity. Last year, it also established the "Advanced Package Group" to expand its packaging business and strengthen inter-departmental collaboration. Currently, Samsung Electronics is considering investing in a new packaging production line to meet the surge in demand for HBM mass production.

SK Hynix plans to invest $15 billion to build a packaging production line in the United States. If it completes subsidy negotiations with the US government, it will speed up the construction of the production line. SK Enpulse acquired ISC, a semiconductor testing solution company, for 500 billion won to enter the semiconductor post-process market. It plans to build the world's first high-performance semiconductor packaging glass substrate mass production plant in Georgia, USA.

Your message must be between 20-3,000 characters!

Your message must be between 20-3,000 characters! Please check your E-mail!

Please check your E-mail!  Your message must be between 20-3,000 characters!

Your message must be between 20-3,000 characters! Please check your E-mail!

Please check your E-mail!